Risks Facing High Net Worth (HNW) Families/individuals: From cyber risks to global travel to kidnapping, HNW families have a host of risks to manage – they face many risks due to their complex lifestyles. The wealth they have accumulated makes their property and casualty exposures more complex than the average person, and their risks often rival those of a business in scope. The frequency and complexity of the risk faced by HNW families/individuals make it necessary to adopt proactive risk prevention strategies.

Cyber Crime: The use of technology and social media, the number of connected devices per household and the number of people (staff, advisers) communicating with HNW families/individuals make them prime targets for cyber-crimes. These crimes can include email phishing, ransomware and unauthorised bank transfers. HNWI’s are also at risk to ‘doxxing’ – the release of personal information about victims and/or their family members; revenge pornography; identity theft; identity fraud and extortion. While the insurance industry is starting to offer insurance protection for some of these losses, the best defense is practicing good cyber hygiene.

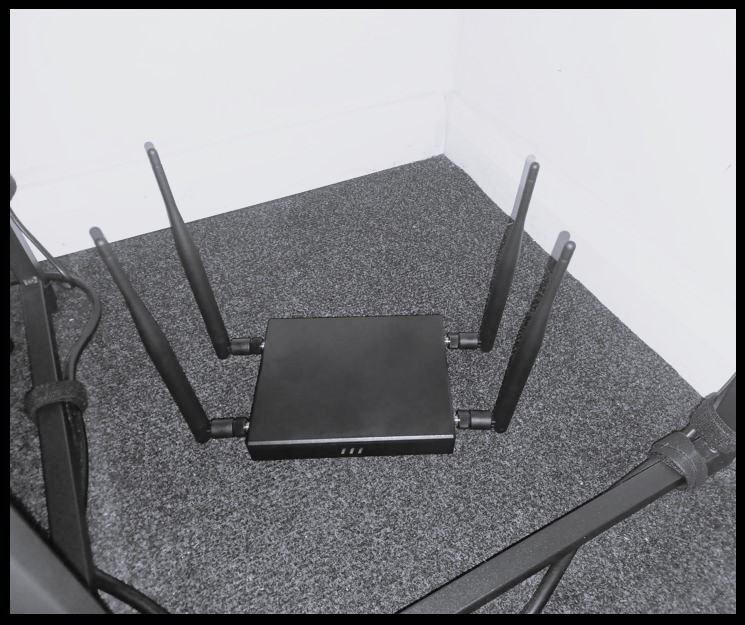

Security Risks: Security concerns can range from home security alarms and devices to worldwide travels concerns. Most Clients are against installing bars on windows, and making their house look like a prison. However, there are things that can be done through architectural detail, landscaping and lighting that can make a difference and be a deterrent. Home security—locks, alarms, motion sensors, gating systems should ideally all be standalone, and not intertwined with apps which can pose cybersecurity risks. Families should consider hiring a local security firm, which is likely to be quicker to react should an incident occur. Install alarms, motion sensors and monitoring devices, and to keep a server, with logs and video, in the home. For some families, safe rooms are a good option, and the need should be assessed. Criminals usually observe their targets for several days/weeks before acting so it’s advisable that families change their daily routines, varying their vehicles, commuting routes and departure times as much as possible. For families with complex risk exposures, consulting with a security expert is recommended. Experts will provide a full risk assessment that will minimise any security breach, such as a home invasion, a cyber breach or any other issue that could put the family at risk.

Travel: When families travel, basic common sense makes a big difference. Keep copies of all important documents, particularly passports and credit cards, in a safe, secondary location, and use your initials and a corporate address, never your full name or home address on your luggage. Avoid public WiFi – the amount of data on a phone, laptop, iPad is so valuable that roaming WiFi should be turned off. Instead, use your mobile service or a personal MiFi device. Assess the potential need for a private security details – large events are an excellent place for all kinds of criminals to operate. Another essential precaution is arranging trusted transportation ahead of a trip – the risk of ‘express kidnappings’ is extraordinarily high when a family is going with someone at an airport who may present themselves as a private driver

Employee-Related Risks: HNWIs can also face threats from staff, even when household workers do not have bad intentions. From housekeepers to drivers, there is a host of individuals trusted by the family who have entry into the home. It could be that they’ve taken pictures in the home and innocently posted them somewhere, and now you have as many as a dozen people who are disclosing information about the family, about the home, about the activities within the home. A family will hire someone to join their inner circle, and they either don’t do checks or do poor due-diligence checks at the point of hire, and then do nothing else on an ongoing basis. A person can be worthy of trust on the day they get hired, but within a matter of months or years later, their profile could change. The solution is thorough vetting before hiring, and regular monitoring of all employees.

Collections Management: HNW families and individuals are known to have a passion for collections, such as art, furniture, memorabilia and cars. Many collections are a significant asset class in their financial portfolio and are managed aggressively to increase value, which may mean the collection is on exhibition or on loan to museums and galleries. This increase in risk exposures requires specialised risk management solutions.

Ownership of Assets: HNW individuals tend to own assets in the names of trusts, LLC and other legal entities. It is critical that they understand the ownership structures of all assets and that all insurance policies are coordinated to properly cover all necessary policies

Professional Liability: Many HNW individuals hold board positions on for-profit, non-profit and not-for-profit boards, yet the majority of individuals do not know if they’re protected with professional liability coverage. If they know coverage is provided, the majority do not know the policy limits or terms and conditions. It is imperative that anyone who holds a board position understands their personal risk exposures and the insurance protection available to them.

Kidnap & Ransom (K&R): In the rare event that families experience a more traditional kidnapping standard K&R insurance is typically insufficient. 99.9% of people will never use their K&R insurance, but everyone should take the time to sit down with their security professional and make a crisis response plan. In an overseas kidnapping situation, the associated Embassy won’t have investigative jurisdiction, and national police are unlikely to assist to any great length. A professional team will know how to coordinate the efforts of a negotiator and an insurance company with the intelligence provided by the kidnapper. In most of situations, the kidnappers want money.

Valkyrie